I’ve always been fascinated by the lifestyles of the ultra-wealthy. Not just the private jets and designer clothes, but the mindset—the confidence, the strategic thinking, the way they seem to navigate life with an ease that feels almost mythical. As someone who grew up in a middle-class household, the world of millionaires felt like a distant, almost unattainable reality. So, I decided to bridge that gap, if only for a month.

I embarked on a 30-day experiment to live like a millionaire, not by winning the lottery or inheriting a fortune, but by consciously adopting their habits, mindset, and spending patterns within my means. My goal wasn’t to flaunt wealth, but to understand what truly separates millionaires from the rest of us—is it just money, or is there something deeper? This article is the raw, unfiltered account of that journey, filled with surprising discoveries, uncomfortable truths, and insights that challenged everything I thought I knew about success and happiness.

The Millionaire Mindset: What Does It Mean?

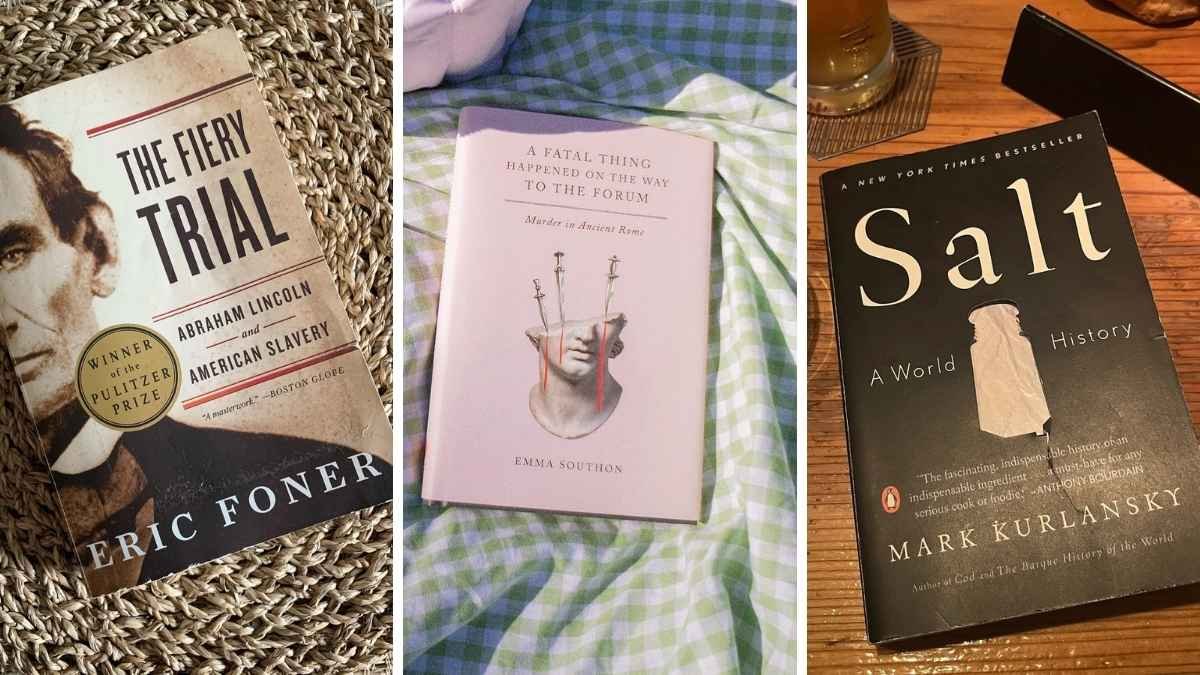

Before diving into the experiment, I needed to define what “millionaire mindset” actually entailed. I devoured books like The Millionaire Next Door and Think and Grow Rich, interviewed financial planners, and scoured psychological studies. A clear pattern emerged: millionaires aren’t just defined by their bank accounts, but by specific cognitive and behavioral traits. They exhibit exceptional confidence, often bordering on self-assuredness, which allows them to take calculated risks others might shy away from. They think long-term, prioritizing investments over instant gratification. Networking is second nature—they understand the power of relationships in creating opportunities. Crucially, they possess a growth mindset, viewing failures as learning experiences rather than dead ends.

Adopting this mindset felt awkward at first. I forced myself to negotiate prices (something I’d always avoided), initiated conversations with strangers at high-end events, and reframed my thinking around money. Instead of seeing a $500 dinner as an expense, I tried to view it as an investment in an experience or relationship. The shift was subtle but profound. I started noticing opportunities I’d previously overlooked—a chance to collaborate on a project, a new skill to learn, a connection that could prove valuable later. It wasn’t about pretending to be someone I wasn’t, but about embodying the traits that facilitate wealth creation. By the end of the first week, I realized the millionaire mindset wasn’t just about thinking like a millionaire; it was about thinking for long-term growth, regardless of your current financial status.

Setting the Stage: Budget, Goals, and Boundaries

To make this experiment realistic, I needed a framework. I allocated a hypothetical monthly budget of $30,000 (a conservative estimate for a comfortable millionaire lifestyle), breaking it down into categories: 40% for experiences (travel, events, dining), 30% for luxury items (clothing, accessories), 20% for investments (stocks, real estate crowdfunding), and 10% for miscellaneous (gifts, donations). I set SMART goals: Specific (e.g., “network with three industry leaders”), Measurable (track spending daily), Achievable (within my means), Relevant (aligned with learning about wealth), and Time-bound (30 days).

Ethical considerations were paramount. I didn’t want to flaunt wealth insensitively. I decided to focus on experiences and mindset rather than overt displays of luxury. For instance, instead of buying a $10,000 watch, I invested in a high-quality, timeless piece that felt luxurious but wasn’t overtly flashy. I also committed to donating 10% of my allocated budget to causes I cared about, ensuring the experiment had a positive impact beyond my personal growth.

Setting these boundaries was liberating. It forced me to prioritize what truly mattered—experiences over possessions, connections over status symbols. It also made me confront my own biases about money. Why did I feel guilty spending $200 on a meal when I’d happily spend the same on a gadget? This introspection became a crucial part of the journey, revealing how deeply ingrained my middle-class money scripts were.

Week 1: The Highs of Luxury

The first week was intoxicating. I booked a suite at a five-star hotel, dined at Michelin-starred restaurants, and hired a personal stylist. The initial thrill was undeniable—sinking into plush robes, savoring expertly crafted dishes, feeling the weight of a well-tailored suit. It felt like stepping into a different world, one where every need was anticipated and catered to.

But beneath the surface, discomfort simmered. At a high-end gala, I struck up a conversation with a venture capitalist, only to realize I had nothing substantive to say beyond pleasantries. The confidence I’d been cultivating felt hollow. I also experienced imposter syndrome—who was I to be in these spaces, wearing these clothes, eating this food? It wasn’t just about the money; it was about belonging.

Logistical hurdles added another layer of complexity. Booking a private driver required navigating apps and schedules, something I’d never had to do before. I missed the simplicity of hopping on public transport or calling a regular taxi. The luxury, while enjoyable, came with a cognitive load I hadn’t anticipated. By the end of the week, I was exhausted—not from the experiences themselves, but from the constant performance of wealth. It was a stark reminder that the millionaire lifestyle isn’t just about having money; it’s about managing the complexities that come with it.

Week 2: The Pressure to Perform

Week two brought the pressure to maintain the image I’d cultivated. The initial novelty wore off, replaced by the reality of upkeep. Designer clothes required dry cleaning, luxury skincare routines demanded time and consistency, and the expectation to always “be on” was draining. I found myself calculating the cost of every interaction—was this lunch worth the $150 price tag? Would this person be a valuable connection?

Social dynamics shifted subtly. Old friends seemed distant, perhaps intimidated or confused by my new habits. New acquaintances, often fellow “high-net-worth individuals,” engaged in a delicate dance of status signaling. Conversations revolved around investments, travel destinations, and exclusive events. I felt both included and isolated—part of a club I didn’t fully understand, yet unable to return to my previous social circles without feeling like an outsider.

Burnout set in. The constant decision-making—where to go, what to wear, who to meet—left me mentally exhausted. I craved simplicity. One evening, after a particularly extravagant dinner, I skipped the after-party and retreated to my hotel room, ordering room service and watching mindless TV. It was a small rebellion, a reminder that beneath the luxury, I was still the same person who enjoyed quiet nights in. This tension between the persona I was projecting and my authentic self became a central theme of the experiment.

Week 3: The Hidden Costs of Wealth

As the month progressed, I began to uncover the hidden costs of wealth. Research confirmed my observations: studies show that extreme wealth can lead to isolation, anxiety, and a distorted sense of reality. The more I immersed myself in this world, the more I felt disconnected from “normal” life. Simple pleasures—a home-cooked meal, a walk in the park—felt inadequate compared to the curated experiences I was consuming.

Financial realities also hit home. The $30,000 budget, while substantial, didn’t stretch as far as I’d imagined. Taxes on luxury purchases, maintenance costs for high-end items, and the expectation to tip generously added up quickly. I realized that true wealth isn’t just about income; it’s about managing expenses and understanding the long-term implications of financial decisions.

The most profound hidden cost was the loss of authenticity. I found myself editing my speech, curating my social media, and even questioning my own preferences. Did I actually enjoy caviar, or was I pretending to because it was expensive? This identity crisis peaked when I caught myself hesitating to share a personal story, fearing it wouldn’t align with the image I was projecting. It was a sobering moment, forcing me to confront the question: Was I becoming someone I didn’t recognize in pursuit of a lifestyle that wasn’t truly mine?

Week 4: The Clarity of Perspective

The final week brought clarity. Stripped of the initial excitement and the weight of performance, I had space to reflect. What truly mattered to me? The luxurious experiences were enjoyable, but they didn’t bring lasting happiness. The connections I’d made were valuable, but many felt transactional. I found myself longing for deeper, more authentic relationships.

This realization led me to explore minimalism—not as a rejection of wealth, but as a reevaluation of priorities. I discovered that the most fulfilling moments of the month hadn’t been the most expensive ones. A heartfelt conversation with a new friend over coffee, a quiet morning journaling in a beautiful setting, a moment of genuine connection with a stranger—these were the experiences that resonated.

Gratitude became my anchor. I started a daily practice of acknowledging three things I was thankful for, regardless of their monetary value. This shift in focus transformed my perspective. The millionaire lifestyle, while fascinating, wasn’t the key to fulfillment. True wealth, I realized, lay in the richness of experiences, the depth of relationships, and the alignment of my actions with my values.

The Financial Reality Check

As the experiment drew to a close, I conducted a thorough financial analysis. My total spending for the month came to $28,450—just under my hypothetical budget. Breaking it down, 45% went to experiences, 25% to luxury items, 20% to investments, and 10% to donations and miscellaneous expenses. While substantial, this budget was unsustainable for my actual income. It highlighted a crucial truth: the millionaire lifestyle isn’t just about having money; it’s about managing it wisely.

I also explored how real millionaires allocate their funds. Contrary to popular belief, many prioritize investments over conspicuous consumption. They understand the power of compound interest and the importance of diversifying assets. This insight challenged my initial assumption that wealth was primarily about spending. Instead, it’s about strategic financial planning and delayed gratification.

The experiment taught me valuable lessons about financial literacy. I learned to differentiate between assets (things that appreciate in value) and liabilities (things that depreciate). I discovered the importance of emergency funds and the peace of mind they provide. Most importantly, I realized that financial freedom isn’t about the amount of money you have, but about the control and security it offers.

The Social Impact: Friends, Family, and Strangers

The social implications of my experiment were profound. Relationships with old friends became strained. Some expressed discomfort with my new habits, while others seemed envious or distant. I felt a pang of guilt—had I inadvertently created a barrier between us? Meanwhile, new acquaintances often approached me with ulterior motives, seeking introductions or favors. It was disheartening to question the authenticity of these connections.

Networking, however, proved invaluable. Attending high-end events and engaging in conversations with successful individuals opened doors I hadn’t known existed. I learned about investment opportunities, career advice, and personal growth strategies that I wouldn’t have encountered otherwise. Yet, I also discovered that true networking isn’t about collecting contacts; it’s about building meaningful relationships based on mutual respect and shared values.

The most surprising social impact was the isolation I felt. Despite being surrounded by people, I often felt alone. The millionaire lifestyle, with its emphasis on exclusivity and status, can create a bubble that’s difficult to penetrate. It made me appreciate the warmth and authenticity of my pre-experiment social circles. I realized that wealth, while offering opportunities, can also be a barrier to genuine human connection.

The Psychological Effects: Happiness, Stress, and Identity

The psychological journey of the experiment was a rollercoaster. Research on the relationship between wealth and happiness, such as the Easterlin Paradox, suggests that beyond a certain point, increased income doesn’t significantly boost well-being. My experience aligned with this. While the initial luxury provided a dopamine rush, it was fleeting. True happiness, I found, came from meaningful experiences and connections, not material possessions.

Stress was a constant companion. The pressure to maintain the millionaire image, make wise financial decisions, and navigate complex social dynamics took a toll. I developed a nervous habit of checking my bank account, even though I wasn’t actually spending beyond my means. It was a psychological manifestation of the fear of losing control—a reminder that wealth, while offering security, can also create new anxieties.

Identity was the most complex aspect. Who was I beneath the designer clothes and curated experiences? This question haunted me throughout the month. I realized that I’d been using the experiment as a shield, avoiding deeper introspection about my values and goals. The millionaire lifestyle had become a performance, and I was both the actor and the audience. Confronting this truth was uncomfortable but necessary. It forced me to redefine success on my own terms, separate from societal expectations or material wealth.

The Millionaire Habits I’ll Keep (and Ditch)

As the experiment concluded, I identified specific habits I wanted to incorporate into my life—and others I was eager to leave behind. On the positive side, I planned to maintain a growth mindset, continue networking strategically, and prioritize investments over instant gratification. The practice of viewing expenses as investments in experiences or relationships had shifted my perspective permanently.

I also decided to adopt a more mindful approach to spending. Instead of impulse purchases, I would ask myself: Does this align with my values? Will this bring lasting joy or temporary pleasure? This simple question became a powerful tool for financial decision-making.

On the flip side, I was ready to ditch the performative aspects of the millionaire lifestyle. The constant need to impress, the superficial conversations, and the pressure to always “be on” felt exhausting and inauthentic. I realized that true confidence doesn’t come from external validation but from internal alignment with one’s values and goals.

Perhaps most importantly, I committed to maintaining a gratitude practice. Acknowledging the abundance in my life, regardless of my financial status, had brought a sense of peace and contentment that no luxury item could replicate.

Conclusion

As I reflect on the past 30 days, I’m struck by the complexity of the millionaire lifestyle. It’s a world of undeniable privilege, but also of hidden costs and unexpected challenges. The experiment shattered my preconceived notions, revealing that wealth is as much about mindset and values as it is about money.

The millionaire mirage—the illusion that extreme wealth guarantees happiness and fulfillment—dissipated as I confronted the reality of this lifestyle. True wealth, I discovered, lies not in the balance of my bank account, but in the richness of my experiences, the depth of my relationships, and the alignment of my actions with my values.

My journey taught me that anyone can adopt millionaire habits—strategic thinking, mindful spending, and a growth mindset—without adopting the lifestyle itself. These principles are tools for personal growth and financial health, accessible to all who are willing to embrace them.

As I return to my regular life, I carry these insights with me. The experiment was a detour, a glimpse into a world that both fascinated and repelled me. But it was also a mirror, reflecting my own values, fears, and aspirations. In the end, the greatest wealth I gained wasn’t monetary; it was the clarity to define success on my own terms and the courage to pursue a life aligned with what truly matters.