Pierce Brosnan’s $100 million Malibu mansion costs him just $300 a year to power.

Yes, you read that right. Three hundred dollars. For an entire year.

Meanwhile, you’re probably paying that much every month (or more) to keep your lights on and your AC running.

What does the former James Bond know that you don’t? He’s mastered something called “sunlight banking” – and it’s not what you think.

This isn’t about expensive solar panels gathering dust on your roof. It’s about transforming your home into a mini power plant that generates income while significantly reducing your energy bills to almost nothing.

Sound too good to be true? Let me show you exactly how it works.

What Is “Sunlight Banking” Really?

The 3-Step Sunlight Banking Process

CAPTURE

Smart solar panels collect sunlight during peak hours (10AM-4PM) when solar production is highest

STORE

Advanced batteries save excess energy for evening peak hours when electricity rates are 80% higher

PROFIT

AI systems automatically sell surplus energy back to grid during peak demand, generating passive income

Energy Arbitrage Opportunity

Buy low at $0.25/kWh (off-peak) → Sell high at $0.45/kWh (peak) = 80% profit margin

Forget everything you think you know about solar power.

“Sunlight banking” isn’t just slapping some panels on your roof and calling it a day. It’s a sophisticated energy storage and trading strategy that the wealthy have been quietly using to eliminate their electricity costs.

Here’s the simple version: Instead of just using solar energy when the sun shines, you store it, manage it, and even sell it back to the grid when prices are highest.

Think of it like this…

Remember when your mom told you to save your allowance instead of spending it immediately? Same concept, but with electricity. You’re essentially becoming your energy bank.

The system works through three main components:

- Smart solar panels that capture energy from the sun

- Advanced battery storage that saves energy for later

- AI-powered management systems that automatically buy, sell, and optimize your energy usage

The result? You could end up with negative electricity bills – meaning the power company pays you.

The Celebrity Energy Revolution Nobody Talks About

You won’t hear about this on the news, but some of the world’s wealthiest people have been quietly revolutionizing their energy costs.

Pierce Brosnan isn’t the only one. His Malibu mansion generates so much surplus energy that he sells it back to the local power grid. What used to be a massive monthly expense is now a small profit center.

Elon Musk was among the first 3,000 people worldwide to get Tesla’s exclusive Solar Roof technology. Even his current $50,000 tiny home in Texas runs on advanced solar banking systems.

Tom Brady and Gisele Bündchen installed dual solar systems on their Massachusetts property that provide complete energy independence.

Johnny Depp converted his entire private island in the Bahamas to solar technology with backup systems.

But here’s what’s interesting…

These aren’t just vanity projects or environmental statements. These are smart financial moves. The wealthy understand something that most people miss: energy independence isn’t just about saving money – it’s about making money.

The Math That Will Blow Your Mind

Let’s talk numbers, because this is where things get exciting.

The average American household spends about $125 per month on electricity. That’s $1,500 per year, or $37,500 over 25 years.

Now here’s where it gets interesting…

Solar banking systems typically pay for themselves in 7.1 years. After that? It’s pure profit.

Over 25 years, most homeowners save between $31,000 and $150,000. That’s like getting an 8-10% annual return on your investment – better than most stocks.

But wait, there’s more.

With smart energy management, you can earn money by selling excess power back to the grid. Some homeowners make $1,200-$1,800 per year just from this energy arbitrage.

Here’s how it works:

- Store cheap energy when rates are low (usually at night)

- Use stored energy during peak hours when rates are high

- Sell surplus energy back to the grid when demand spikes

It’s like buying low and selling high, except with electricity instead of stocks.

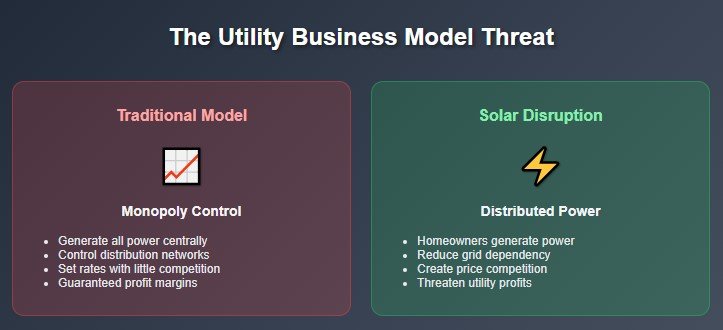

Why Your Power Company Doesn’t Want You to Know This

Here’s where things get a little shady.

The Edison Electric Institute (the trade group representing major utilities) has been running a systematic campaign against home solar since 2012. They’re terrified of what they call the “utility death spiral.”

Why? Because when you generate your power and sell excess back to them, they lose money. A lot of it.

Think about it from their perspective. They’ve built their entire business model around selling you electricity. When you stop buying it – and start competing with them – that’s a problem.

Phil Moeller from EEI argues that solar customers “unfairly shift electricity costs onto the most vulnerable customers.” But here’s what they’re not telling you…

You’re still paying for grid access and maintenance through connection fees. Plus, you’re helping stabilize the grid by providing power during peak demand periods.

California recently reduced payments to solar customers by 75% after heavy utility lobbying. The result? Solar sales dropped 77-85% and the industry lost 17,000 jobs.

This is utilities using their political influence to protect their profits at your expense.

The Technology Revolution Happening Right Now

The good news? The technology is advancing so fast that utility resistance won’t matter much longer.

Battery costs dropped 33% in 2024 alone. What used to be prohibitively expensive is now becoming mainstream.

Here’s what’s coming next:

Solid-State Batteries

These new batteries last 8,000-10,000 charge cycles compared to 1,500-2,000 for current systems. That means they’ll outlast your mortgage.

Vehicle-to-Grid Integration

Your electric car becomes a massive battery for your home. Ford’s F-150 Lightning can power your house for up to 10 days during an outage.

AI-Powered Optimization

Smart systems that automatically manage your energy usage, predicting weather patterns and electricity prices to maximize your savings. No manual work required.

Virtual Power Plants

Your home joins a network of thousands of other solar homes, creating a “virtual power plant” that can sell energy to the grid at utility-scale prices.

The Department of Energy projects this could save utility customers $10 billion annually by 2030.

How Much Does This Cost?

Complete System Cost Breakdown

Solar System

Before incentives

$18,816 after 30% tax credit

Battery Storage

Tesla Powerwall 3

$11,130 after 30% tax credit

Total Investment

Complete system

$29,946 after tax credit

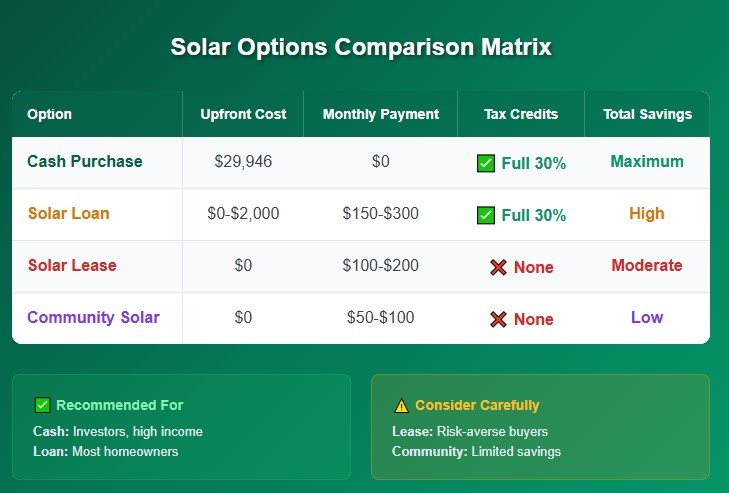

Financing Options Comparison

Cash Purchase

Pros: Max savings, full credits

Cons: High upfront cost

Solar Loan

Rate: 2.99% – 8%

Term: 5-30 years

Solar Lease

Pros: No upfront cost

Cons: No tax credits

Let’s cut to the chase. You’re probably wondering: “This sounds great, but what’s the real price tag?”

The average residential solar system costs about $26,880 before incentives. After the 30% federal tax credit, you’re looking at around $18,816.

Add a Tesla Powerwall battery system for another $15,400-$16,500 (before incentives), and your total investment is roughly $34,316.

I know what you’re thinking. That’s a lot of money upfront.

But here’s the thing…

You don’t have to pay cash. Solar loans are now available from 2.99% to 8% interest with terms up to 30 years. Your monthly loan payment is often less than your current electricity bill.

Plus, you start saving money immediately while building equity in a system that increases your home’s value.

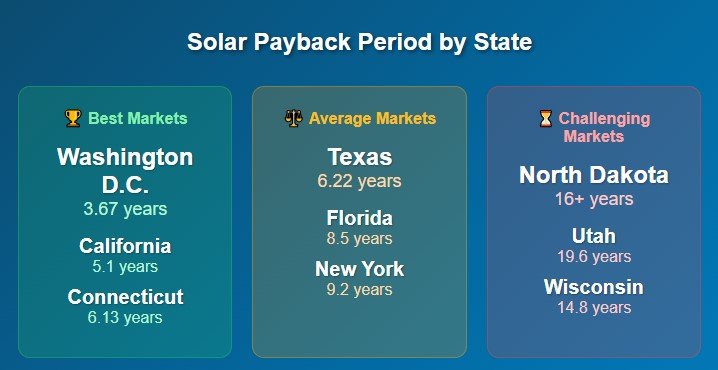

The State-by-State Reality Check

Not all locations are created equal when it comes to solar banking.

The best markets offer payback periods under 6 years:

- Washington D.C.: 3.67 years

- California: 5.1 years

- Connecticut: 6.13 years

- Texas: 6.22 years

The challenging markets require patience:

- Utah: 19.6 years

- North Dakota: 16+ years

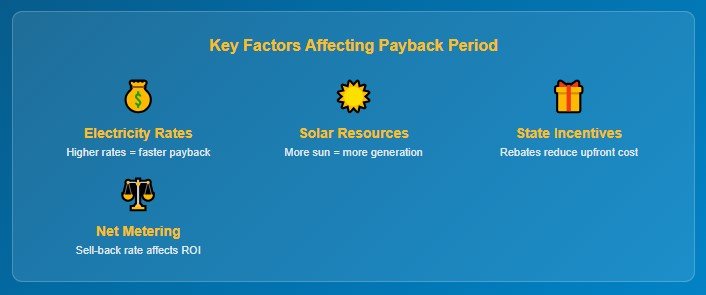

Why the difference? Three main factors:

- Electricity rates (higher rates = faster payback)

- Solar incentives (state and local rebates)

- Net metering policies (how much utilities pay for your excess power)

The good news? Even in slower markets, you’ll eventually save money. And technology improvements are making solar viable everywhere.

Different Ways to Get Started

You don’t have to go all-in from day one. Here are your options:

Option 1: Buy the System Outright

- Pros: Maximum savings, full tax credits, no monthly payments

- Cons: High upfront cost

- Best for: People with available cash who want maximum returns

Option 2: Solar Loans

- Pros: No money down, immediate savings, keep tax credits

- Cons: Interest charges, monthly payments

- Best for: Most homeowners who want to own their system

Option 3: Solar Leases/PPAs

- Pros: No upfront cost, predictable monthly payments

- Cons: No tax credits, less total savings, locked into contract

- Best for: People who want simple, low-risk solar

Option 4: Community Solar

- Pros: No roof installation needed, lower cost entry

- Cons: Limited availability, less control

- Best for: Renters or homes with poor solar exposure

What’s Coming Next?

The solar banking revolution is just getting started.

By 2030, experts predict:

- Solar costs will drop another 50%

- Battery storage will become 70% cheaper

- Virtual power plants will manage 80-160 GW of capacity

- Most new homes will include solar as standard

The big trend to watch? Energy-as-a-service models, where you pay one monthly bill that includes generation, storage, and grid services. Think Netflix, but for electricity.

Companies like Tesla Electric are already offering this in Texas, bundling solar generation with electricity supply into single monthly payments that replace your utility bill entirely.

Your Action Plan

5-Step Solar Banking Action Plan

Assess Your Situation

Get Multiple Quotes

Run the Numbers

Consider Timeline

Start Smart

⚡ Quick Start Calculator

Annual electricity cost × 25 years = Your potential savings opportunity

Example: $1,500/year × 25 years = $37,500 savings opportunity

Ready to join the energy revolution? Here’s your step-by-step game plan:

Step 1: Check Your Situation

- Review 12 months of electricity bills

- Assess your roof’s solar potential (direction, shading, age)

- Research your state’s incentives and net metering policies

Step 2: Get Multiple Quotes

- Contact 3-5 local solar installers

- Compare system sizes, equipment brands, and financing options

- Ask about battery storage options and costs

Step 3: Run the Numbers

- Calculate your payback period

- Project 25-year savings

- Factor in tax credits and local incentives

Step 4: Consider Your Timeline

- Federal tax credit stays at 30% through 2032

- Some local incentives have waiting lists or may expire

- Technology keeps improving, but don’t wait forever

Step 5: Start Small If Needed

- Begin with solar panels only, add batteries later

- Consider community solar as a stepping stone

- Use online calculators to model different scenarios

The Bottom Line

The wealthy aren’t adopting solar banking systems to save the planet – they’re doing it to save money and make money.

Pierce Brosnan’s $300 annual electricity bill isn’t magic. It’s the result of treating energy like any other investment opportunity.

The technology has reached the point where it makes financial sense for most homeowners. Average payback periods of 7.1 years, lifetime savings exceeding $100,000, and annual returns competing with stock market investments make this a legitimate wealth-building strategy.

Sure, utilities are fighting back with political lobbying and policy changes. But the economics are becoming too compelling to ignore.

The question isn’t whether solar banking will become mainstream – it’s whether you’ll be an early adopter or wait until everyone else catches on.

Your move. Will you keep paying your utility company $1,500+ per year, or will you join the billionaires who’ve figured out how to make their homes pay them instead?

Ready to see how much you could save? Start by pulling out your last 12 months of electricity bills and adding up the total. That number might just motivate you to take the next step toward energy independence.