You know that sinking feeling when you realize you’ve been doing something wrong for years?

I’m about to give you that feeling about housing decisions. But stick with me—because what I’m going to share could save you six figures over your lifetime.

Here’s the thing: 96% of major U.S. cities favor renting over buying right now. Yet somehow, 86% of Americans still think homeownership equals financial success. We’re collectively making a massive, expensive mistake.

The “rent vs. buy” question everyone obsesses over? It’s the wrong question entirely. And it’s costing regular people hundreds of thousands of dollars they’ll never get back.

The Numbers That’ll Make Your Head Spin

Let me hit you with some reality. Right now, homeowners are spending $27,205 annually on housing costs while renters pay $22,137. That’s a $5,068 yearly penalty just for owning.

But here’s where it gets wild.

In San Jose, renters save $5,598 every single month compared to owners. That’s $67,176 per year. Even if you account for tax benefits and home appreciation, that’s life-changing money sitting on the table.

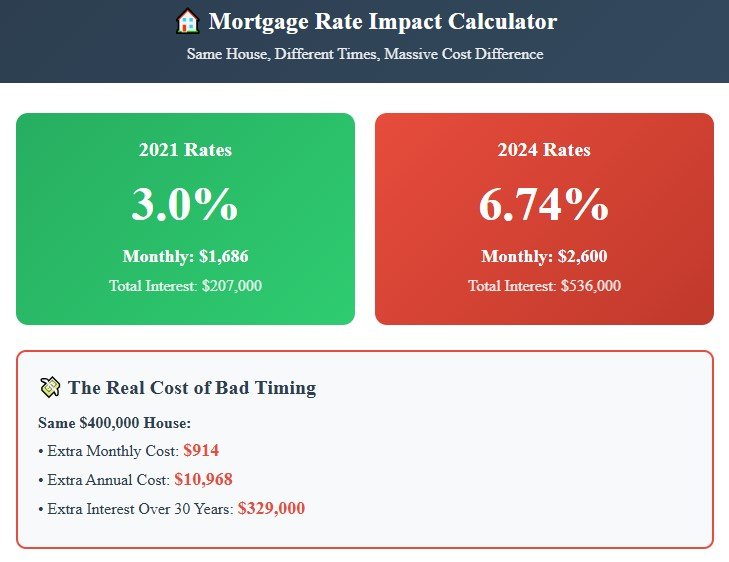

And it’s not just expensive cities. The math has fundamentally broken everywhere due to one brutal reality: mortgage rates jumped from 3% to 6.74% in just two years. Your monthly payment on a $400,000 home increased by about $800 overnight—without the house getting any better.

Think about that for a second. The same house, same neighborhood, same everything—but now costs $800 more per month just because of when you decided to buy.

The $462,000 Mistake (Yes, Really)

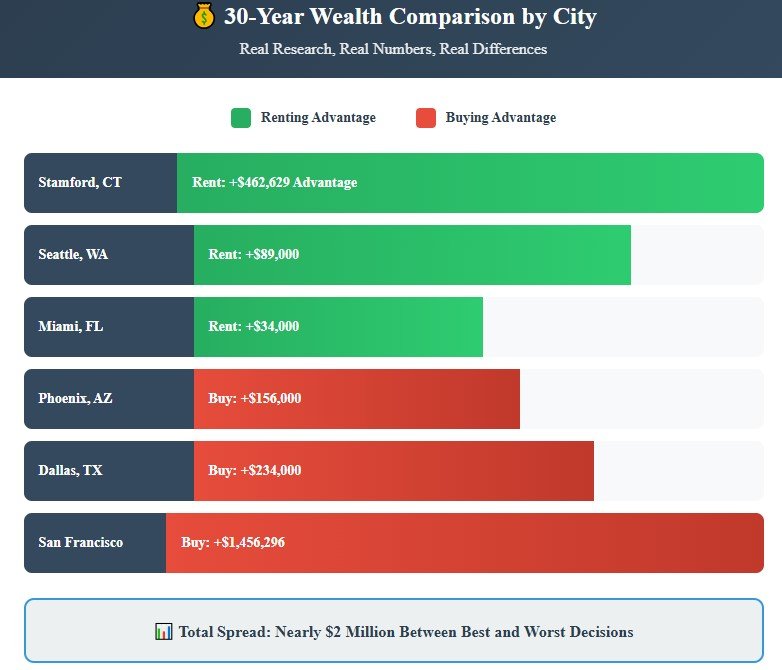

Here’s a number that should keep you up at night: $462,629.

That’s how much more wealth renters built compared to buyers over 30 years in Stamford, Connecticut, according to University of Northern Iowa research. On the flip side, buyers in San Francisco came out $1.4 million ahead.

The total spread? Nearly $2 million.

Your housing strategy isn’t just about monthly payments—it’s about your entire financial future. And most people are flying blind.

Why Smart People Make Dumb Housing Decisions

You’re probably wondering: “If the math is this clear, why is everyone getting it wrong?”

Welcome to your brain working against you.

30% of Americans admit they feel social pressure to buy a home, even when they know renting would save money. We’re paying a “stigma tax” to avoid judgment from friends and family.

Then there’s what psychologists call “anchoring bias.” You see a house listed for $450,000, and suddenly $420,000 feels like a steal—even if the house is only worth $380,000. Your brain gets stuck on that first number.

But here’s the kicker: average homeowners think real estate returns 14% annually. The actual number? About 6.8% after maintenance costs. We’re making decisions based on fantasy numbers.

Your parents, your friends, even your real estate agent—everyone’s operating on outdated assumptions from when mortgages were 3% and houses cost half what they do today.

The “5% Rule” That Changes Everything

Want a quick way to know if you should rent or buy? Here’s the simplest test I know.

Take any home’s price and multiply by 5%. Divide that by 12. If rent costs less than that number, you should rent. If rent costs more, buying makes sense.

For a $400,000 home: $400,000 x 0.05 = $20,000 ÷ 12 = $1,667/month

If you can rent something comparable for less than $1,667, you’re throwing money away by buying. If rent costs more than $1,667, buying could make sense.

Right now, this calculation favors renting in most American cities. That’s not opinion—that’s math.

The Hidden Wealth-Building Secret Nobody Talks About

Here’s what blew my mind when I started digging into this stuff.

Remember that $100,000 you’d put down on a house? If you invested it in the stock market instead and it earned 7% annually, you’d have $761,000 after 30 years. Without adding another penny.

Meanwhile, real estate? After inflation, it barely beats keeping money under your mattress. Robert Shiller’s research shows housing returns just 0.2% annually after inflation.

But wait, there’s more. (I know, I sound like an infomercial, but bear with me.)

That extra $289 per month you’re saving by renting instead of buying? Invested at 7% annually for 30 years, that becomes another $348,000.

We’re talking about over $1 million in additional wealth just from making the “wrong” housing choice, according to conventional wisdom.

Meet the People Gaming the System

While everyone else argues about rent vs. buy, there’s a group of people quietly building massive wealth through strategies you’ve probably never heard of.

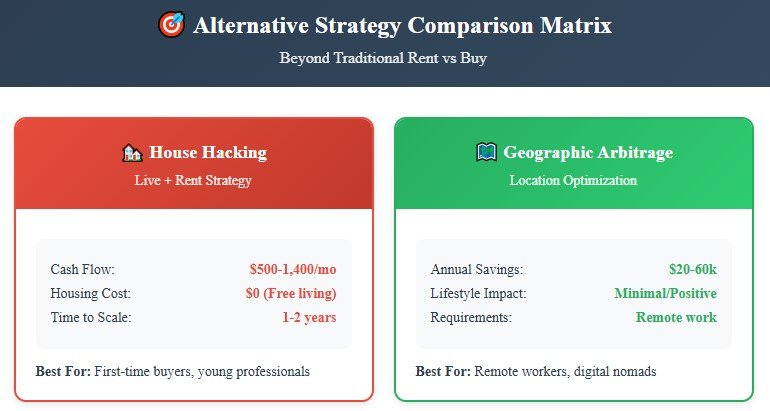

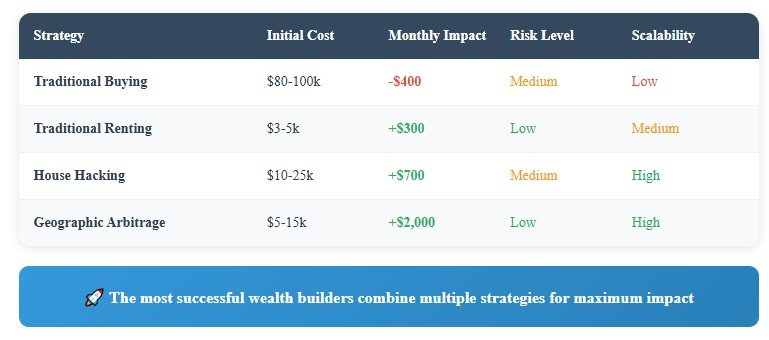

Take Craig Curelop. This guy bought a duplex, lived in one side, and rented out the other. His rent covered the mortgage, plus he gave him $850 monthly profit. He lived for free and made money.

His next move? A 5-bedroom house where he rented out four rooms for $3,100 total against a $2,000 mortgage. That’s $700 monthly profit while living in a nice house essentially for free.

Within three years, his passive income exceeded his living expenses. He basically hacked his way to financial independence through housing while his friends were still arguing about whether they could afford a down payment.

This is called “house hacking,” and it’s not just for real estate moguls. Regular people are doing this all over the country.

The Geographic Money Glitch

Here’s another secret that’s hiding in plain sight: where you live matters more than what you pay.

Moving from San Francisco to Tulsa saves you $59,000 per year. Same lifestyle, same everything—just $59,000 more in your pocket annually.

For remote workers, this is free money. A $120,000 salary in San Francisco has the same buying power as $61,000 in Tulsa. Except you get to keep the San Francisco salary while living with Tulsa costs.

That’s a $59,000 annual raise just for changing your zip code.

I know a software engineer who moved from Seattle to Austin during the pandemic. His salary stayed the same, but his cost of living dropped by $2,800 per month. That’s $33,600 per year he can now invest instead of giving to a landlord or mortgage company.

Why the Old Rules Don’t Work Anymore

Everything changed in 2020, and most people haven’t caught up.

82% of homeowners with mortgages have rates below 6%, so they’re not selling. This created an artificial housing shortage that drove prices through the roof while making new purchases financially toxic.

Add in climate risks—$121-237 billion in real estate is overvalued due to unpriced flood and storm exposure—and you’ve got a market where traditional buy-and-hold strategies are increasingly dangerous.

Florida properties alone are overvalued by $50 billion because people aren’t properly pricing in hurricane and sea-level rise risks. Properties in high sea-level rise areas have gained only 2% value since 2022, versus 7% for safer locations.

That’s a $20,000 difference on a $400,000 home that will likely get much worse as climate impacts accelerate.

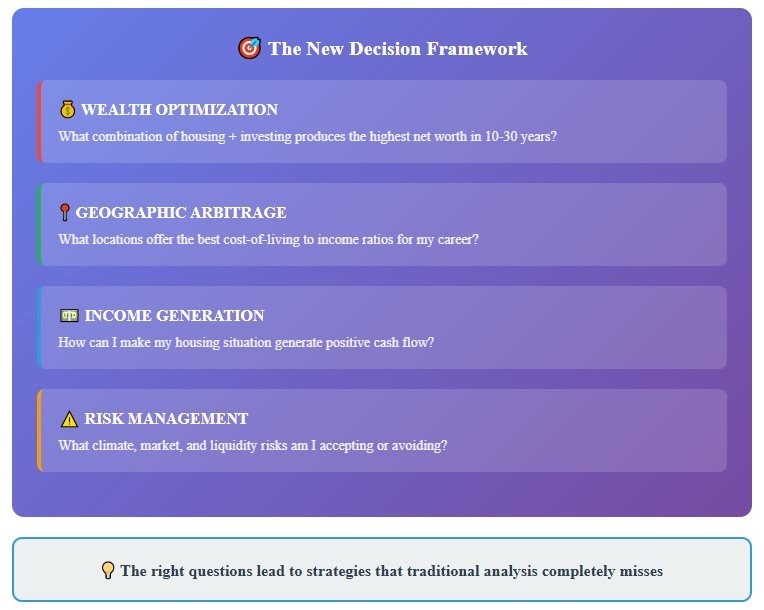

The Questions You Should Be Asking

Instead of “Should I rent or buy?” here are the questions that matter:

How can I minimize my housing costs while maximizing my investment potential?

What geographic arbitrage opportunities am I missing?

How can I generate income from my housing situation?

What climate and technology risks am I not considering?

How does this decision impact my path to financial independence?

These questions lead to strategies that traditional rent vs. buy analysis completely misses.

The Smart Money’s Next Moves

The most successful people I know treat housing as one part of a broader wealth-building strategy, not an isolated lifestyle choice.

They’re using house hacking to eliminate housing costs while generating income. They’re leveraging geographic arbitrage to pocket massive cost-of-living differences. They’re avoiding climate-risky areas before the market fully prices in those risks.

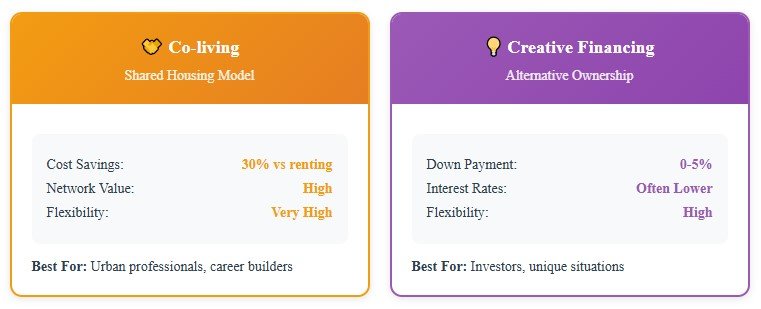

Some are embracing co-living arrangements that cut housing costs by 30% while building valuable networks. Others are using creative financing like owner financing or lease options to control properties without traditional mortgages.

The common thread? They’re asking better questions and getting better answers.

Your Next Step (Do This Today)

Here’s what I want you to do right now:

Calculate your real housing costs using the 5% rule. Take your area’s median home price, multiply by 0.05, and divide by 12. Compare that to current rent prices.

If renting wins, start investing the difference in low-cost index funds. If buying wins, make sure you’re planning to stay at least 7 years and can handle the full costs of ownership.

But more importantly, start thinking beyond the rent vs. buy box. What creative housing strategies could accelerate your wealth building? What geographic arbitrage opportunities are you missing? How could you generate income from your housing situation?

The Americans building real wealth through housing aren’t asking whether to rent or buy. They’re asking how to optimize their entire financial strategy through smart housing decisions.

The difference isn’t just a few percentage points of return. It’s the difference between retiring at 35 or 65. It’s the difference between financial stress and financial freedom.

The choice is yours. But now at least you know what choice you’re making.