Ever wonder why your millionaire neighbor drives a 10-year-old Honda and lives in that modest ranch house? Here’s the billion-dollar secret they don’t want you to know.

You know that friend who always seems to have money for everything but never talks about being rich? The one who drives a reliable Toyota, lives in a nice-but-not-flashy neighborhood, and somehow always has cash for opportunities?

They might be practicing “stealth wealth” – and their secret weapon could be sitting right in your backyard.

While everyone else is chasing luxury penthouses and Instagram-worthy properties, the smartest real estate investors are quietly building massive fortunes with the most boring properties. We’re talking about modest duplexes, small apartment buildings, and middle-class rental homes that wouldn’t get a second glance on HGTV.

Here’s the shocker: These “boring” properties are crushing luxury real estate returns by up to 47%.

The Numbers Don’t Lie (And They’re Pretty Amazing)

Let me hit you with some data that’ll make you rethink everything you know about real estate investing.

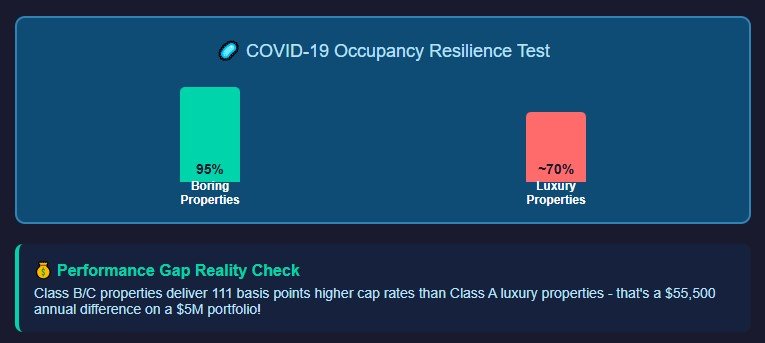

Class B and C properties – that’s investor-speak for modest, middle-income housing – are delivering cap rates of 5.8% to 6.1% while luxury properties struggle at around 4.99%. That might not sound like a huge difference, but over 10 years, we’re talking about hundreds of thousands in extra returns.

But here’s where it gets really interesting: During COVID-19, these boring properties maintained 95% occupancy rates while luxury markets went into free fall.

Think about it. When the world turned upside down, people still needed affordable places to live. But those $5,000-a-month luxury apartments? Suddenly, they weren’t so essential.

Grant Francke learned this lesson the hard way. He was working as a railroad conductor – not exactly a glamorous job – when he decided to start investing in real estate. Instead of reaching for luxury properties, he focused on modest duplexes and small multifamily buildings.

Three years later? He had built an $8+ million portfolio.

His secret wasn’t some complex strategy or insider knowledge. He just bought boring properties that working people needed.

Why “Boring” Is Brilliant

Here’s something that might blow your mind: 74% of actual millionaires live in homes worth less than $1 million.

While social media shows us million-dollar mansions and celebrity real estate, real wealth is being built quietly in middle-class neighborhoods across America.

These stealth wealth investors have figured out something crucial: Essential beats flashy every time.

When you own workforce housing – properties that serve teachers, nurses, mechanics, and other essential workers – you’re not just investing. You’re providing something people need, regardless of economic conditions.

The Rent Security Factor

Let’s talk about tenant stability for a second. This is where boring properties shine.

Workforce housing tenants stay an average of 3-5 years, compared to just 1-2 years for luxury renters.

Why? Because these folks are renting out of necessity, not choice. They’re not apartment-hopping every year looking for the latest amenities. They want a clean, safe, affordable place to call home – and when they find it, they stick around.

This means less turnover, fewer vacancy periods, and more predictable cash flow. As one investor told me: “My boring properties are like clockwork. Same tenants, same rent, same profits month after month.”

The Tax Advantage Nobody Talks About

Okay, this is where things get exciting – but also a bit technical. Stay with me because this could save you tens of thousands in taxes.

Cost segregation studies can increase your first-year depreciation by 134%.

Let me break that down in real numbers. On a $500,000 property, instead of depreciating $18,181 in year one, you could potentially depreciate $42,565. At a 37% tax rate, that’s an extra $9,022 in tax savings – real money back in your pocket.

But here’s the kicker: boring properties have operating expense ratios of 35-45%, compared to 50-65% for luxury properties.

What does this mean for you? On a $2 million property generating $200,000 in income, you’re looking at $30,000 more in annual net operating income just from lower expenses.

The Compound Effect Is Insane

Let’s play with some numbers for a minute. Say you invest $1 million using the boring property strategy versus the luxury route:

- Boring properties: 12.5% first-year returns

- Luxury properties: 8.5% first-year returns

Over 10 years, reinvesting those tax savings annually, you end up with a $1.4 million wealth differential. That’s 78% more wealth just from choosing boring over flashy.

Where the Smart Money Is Going Right Now

Low institutional competition

Affordable entry points

Strong rental demand

So where exactly are these stealth wealth investors putting their money? The answer might surprise you.

Fort Wayne, Indiana, is currently the #1 market nationally for workforce housing investment. Not Miami, not Los Angeles – Fort Wayne.

Follow that with Omaha, Nebraska, and Columbus, Ohio. These Midwest markets are seeing 4-6% appreciation potential while avoiding the institutional investor feeding frenzy that’s driving up prices in coastal markets.

Here’s why this matters: while everyone’s fighting over the same luxury properties in hot markets, you can still find solid workforce housing deals in these overlooked areas.

The Climate Migration Advantage

Here’s a trend most people aren’t talking about yet: climate migration.

Eastern U.S. and Midwest markets are seeing 10.8% value increases through 2055 as people move away from climate-vulnerable areas. Guess where they’re moving to? Those same boring markets where workforce housing thrives.

It’s like positioning yourself ahead of a wave that’s already building.

The Management Sweet Spot

One of the best parts about boring properties? They’re easier to manage.

Think about it: a basic duplex needs standard appliances, standard maintenance, standard everything. Compare that to a luxury property with high-end finishes, smart home systems, and tenants who expect white-glove service.

Standard appliances break less and cost less to replace. When your tenant’s dishwasher dies, you’re not shopping for a $3,000 European model – you’re grabbing a reliable unit from Home Depot for $600.

Plus, workforce housing tenants tend to be more understanding about maintenance issues. They’re not threatening to move out because the granite countertop has a small chip.

The Technology Factor

Property management technology is making this even easier. AI adoption is reaching 30% of property managers by 2026, and these tools work particularly well with workforce housing.

Automated rent collection, digital maintenance requests, and data-driven tenant screening are reducing the complexity while improving your returns. It’s like having a property management assistant that never sleeps.

What About the Risks? (Because There Are Always Risks)

Look, I’m not going to blow sunshine and tell you this is risk-free. Every investment has downsides, and stealth wealth real estate is no exception.

Interest rates at 6.5-7.5% through 2027 are making financing more expensive across the board. Operating costs have doubled since 2022 in many markets. And if you concentrate all your properties in one area, you’re exposed to local economic downturns.

The Hidden Social Risk

Here’s something most people don’t consider: the social aspect of stealth wealth can be challenging.

Maintaining a modest lifestyle while building substantial wealth can feel isolating. You might find yourself surrounded by people who don’t understand your investment philosophy or who pressure you to “upgrade” your lifestyle.

Some investors become so focused on the conservative approach that they miss legitimate opportunities in stronger markets.

The Smart Way Forward

So how do you implement this strategy without making costly mistakes?

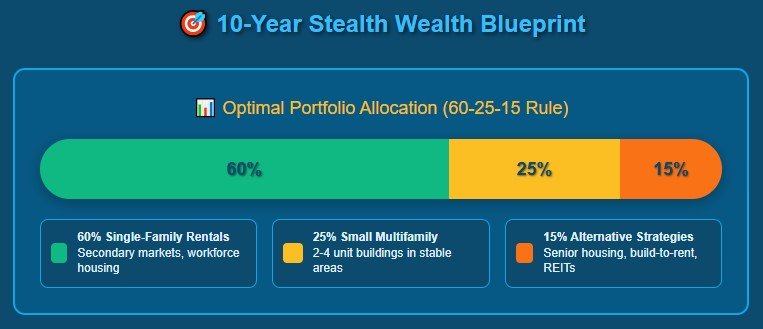

Start with the 60-25-15 rule:

- 60% single-family rentals in secondary markets

- 25% small multifamily in workforce housing areas

- 15% alternative strategies (senior housing, build-to-rent)

Target markets where median home prices stay below $450,000, unemployment is under 4.2%, and there’s a diverse economic base. You don’t want to be dependent on one major employer or industry.

Your 10-Year Game Plan

Years 1-2: Acquire 2-3 properties while learning the ropes and building your team (accountant, property manager, reliable contractors).

Years 3-5: Scale to 5-8 properties using cash flow and strategic refinancing. Start diversifying geographically.

Years 6-10: Optimize your portfolio, consider 1031 exchanges for larger properties, and start thinking about legacy planning.

The goal is 12-15% total annual returns with 1.2-1.5% monthly cash flow ratios. If you’re hitting those numbers consistently, you’re on track to build serious wealth.

Why This Matters More Than Ever

We’re at a unique moment in real estate history. New multifamily construction is projected to drop 27%, creating supply constraints that benefit existing rental property owners.

The rental market is shifting from oversupply to undersupply, particularly in workforce housing. Meanwhile, institutional investors are pulling back due to higher financing costs, creating opportunities for individual investors who can move quickly.

Single-family rentals are outperforming apartments with 4.4% versus 2.4% rent growth – playing directly to the strength of the boring property strategy.

Add in baby boomer downsizing and climate migration patterns, and you’ve got multiple tailwinds supporting this approach for years to come.

The Bottom Line: Boring Builds Billions

Here’s what the data tells us, and what successful stealth wealth investors have known for years: sustainable wealth comes from providing essential services to working Americans, not from chasing speculative luxury markets.

The numbers don’t lie. Boring properties deliver superior risk-adjusted returns while building substantial wealth without attracting unwanted attention or regulatory scrutiny.

Your millionaire neighbor in the modest ranch house? They probably figured this out years ago. While everyone else was chasing the flashy deals and Instagram-worthy properties, they were quietly building a boring – but highly profitable – real estate empire.

The question isn’t whether this strategy works; the question is whether it works. The data proves it does, dramatically and consistently.

The question is: Are you ready to embrace boring and start building your stealth wealth empire?

The best time to start was 10 years ago. The second-best time is right now, while the window of opportunity is still wide open. What’s your first move going to be?