You walk into a dealership, eyes gleaming with excitement. There’s a shiny new car you’ve had your eye on for months, and the salesman greets you with a smile, sliding a piece of paper across the table.

“Zero percent APR for 60 months!” he declares. “This is the deal of a lifetime.” You sign on the dotted line, relieved to secure such a “great” financing package. But when the first monthly payment arrives—higher than you expected—a sinking feeling settles in your stomach. What went wrong?

Welcome to the world of car financing, where dealerships thrive on obscurity and profit often trumps transparency. The reality is, those “too good to be true” offers are carefully crafted to prioritize the dealer’s bottom line, not your financial well-being.

Behind the flashy advertising and smooth sales pitch lies a web of mathematical truths that dealers hope you’ll never uncover. Let’s know about them.

How Car Financing Works: The Mathematical Basics

Know the Math: The 3 Pillars of Your Car Loan

Principal

The actual amount you borrow to buy the car.

This isn’t the final price you pay!

Interest (APR)

The cost of borrowing money, expressed as a percentage.

A low APR can hide other costs.

Term Length

The duration of your loan (e.g., 60 months).

Longer term = HIGHER total cost.

Before we dive into the dealer’s playbook, let’s establish a solid understanding of the mathematical foundations of car financing. Three key concepts form the backbone of any auto loan: principal, interest, and term length. Grasping these elements empowers you to see through the haze of sales jargon and make informed decisions.

Principal vs. Interest: The Twin Forces of Your Loan

The principal is the actual amount you’re borrowing to buy the car. Simple enough, right? But here’s the catch—this isn’t the only number that determines your payments.

Interest, calculated as a percentage of the principal, represents the cost of borrowing money. Over time, interest can add up significantly, sometimes even doubling the amount you pay for your vehicle.

APR: The Number That Isn’t Always What It Seems

Annual Percentage Rate, or APR, is the benchmark most people use to compare loans. It represents the yearly cost of borrowing, including fees and other charges.

But dealerships often manipulate APR to create the illusion of a better deal. A "low" APR might come attached to a longer loan term, or hidden fees might be buried in the fine print, inflating your total cost without changing the advertised rate.

The Term Length Trap

How 12 Extra Months Can Cost You Over $1,100

Scenario: Financing a $30,000 car at 5% APR.

$560/mo

Total Interest: $3,580

$459/mo

Total Interest: $4,693

Choosing the lower monthly payment costs you

$1,113 MORE

in the long run.

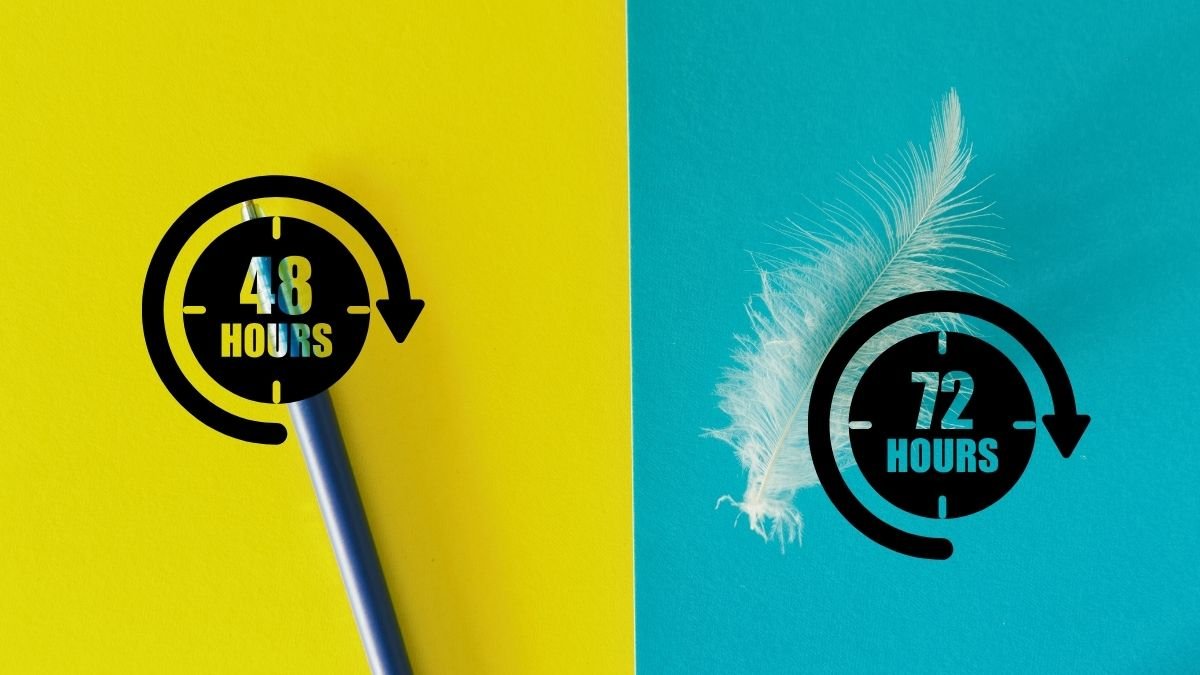

Term Length: The Double-Edged Sword

The duration of your loan, or term length, dramatically impacts both your monthly payments and the total interest you’ll pay. Opting for a longer term reduces your monthly obligation but extends the period over which interest accrues. This seemingly appealing option can cost you thousands in the long run.

Let’s illustrate these concepts with a concrete example. Suppose you’re financing a $30,000 car at 5% APR over 60 months. Using a standard loan calculator, your monthly payment would be approximately $559.67. Over the term of the loan, you’d pay a total of $3,580.24 in interest.

Now, if that same loan were stretched to 72 months (six years), your monthly payment drops to around $458.71—but the total interest skyrockets to $4,693.03. By extending the term by just 12 months, you’d pay over $1,100 more in interest. This simple adjustment demonstrates how term length profoundly influences your overall cost.

Hidden Costs Dealerships Don’t Disclose

Are You Financing More Than Just the Car?

Dealerships roll fees into your loan, making you pay interest on them.

Car Price

$20,000

Rolled-In Fees

$2,000

Your Actual Loan Principal

$22,000

The Impact:

Those "minor" fees will cost you an extra $1,152 in interest over a 60-month loan at 5% APR.

Now that we’ve covered the basics, let’s explore the less obvious elements dealerships prefer to keep under wraps. These hidden costs can dramatically alter the financial landscape of your purchase, yet they’re rarely discussed upfront.

Rolled-In Fees: The Principal Inflators

Dealerships excel at embedding additional charges into your loan principal. Document fees, preparation fees, dealer markup, and extended warranties are commonly rolled into the financing package.

While these fees might seem minor individually, they collectively increase your loan principal, which in turn raises your monthly payments and the total interest you’ll pay over the loan term.

Consider a $20,000 car with $2,000 in rolled-in fees. Your loan principal suddenly becomes $22,000. At 5% APR over 60 months, this increases your monthly payment by approximately $19.20 and adds $1,152 to your total interest paid. These fees compound over time, creating a snowball effect that dealerships count on you overlooking.

Manufacturer Rebates vs. Low APR: The Either/Or Trap

The Either/Or Trap

You're offered a rebate OR low APR financing. You usually can't have both.

Path 1: 0% APR

The dealer may have marked up the car's price to compensate.

Path 2: Rebate

You get cash back, but pay a standard interest rate.

Actionable Tip:

Always ask if the vehicle's price changes when you choose the financing deal over the cash rebate. The "better" deal isn't always obvious.

Many dealerships present you with a choice: take advantage of a manufacturer rebate or opt for a low APR financing deal. What they often fail to mention is that these options are mutually exclusive. If you choose the low APR, you typically forfeit the rebate, and vice versa.

Let’s say a car has a $2,000 manufacturer rebate. If you opt for a 0% APR deal instead, you might assume you’re saving money. But if the dealer has marked up the vehicle’s price by $2,000 to offset the lost rebate, your total cost remains the same—or may even be higher.

Always ask whether a rebate and low APR can be combined, and verify the vehicle’s pricing against market values to ensure you’re not being charged a premium for your financing choice.

Balloon Payments: The Final Surprise

The Ticking Time Bomb

Balloon payments offer low monthly payments, but hide a massive final bill.

On a $20,000 car, after 3 years of low payments...

A sudden

$10,000

payment is due!

The Risk:

If you can't pay, you might be forced to refinance at a worse rate or lose the car entirely.

Balloon payment financing structures entice buyers with low monthly payments, but they come with a significant catch. A balloon payment is a large, lump-sum payment due at the end of the loan term. Dealerships determine this payment based on the vehicle’s projected residual value, often around 50% of the purchase price.

For example, on a $20,000 car with a 50% balloon payment after three years, you’d make monthly payments based on the $10,000 financed amount. At the end of the term, however, you’re hit with a $10,000 payment.

If you can’t afford this, you might be forced to refinance—often at a higher interest rate—or return the car, potentially damaging your credit. Balloon payments create a false sense of affordability while transferring substantial risk to the buyer.

The Truth About "Zero Percent APR" Deals

"Zero percent APR!" The words themselves sound like a miracle. Who wouldn’t want to borrow money for free? But as with many things that seem too good to be true, there’s more to the story.

Limited Eligibility: The Credit Score Gatekeeper

Zero percent APR offers are typically reserved for buyers with exceptional credit scores—usually 750 or higher. Dealerships rarely advertise this restriction prominently. Even if your credit is good but not exceptional, you might spend hours negotiating and completing paperwork, only to discover at the last minute that you don’t qualify for the advertised rate. By then, you may feel pressured to accept a higher APR or walk away empty-handed.

Price Markups: The Hidden Equalizer

"Free Money" Isn't Free: The Truth About 0% APR

Catch #1: The Credit Score Gatekeeper

0% APR offers are typically reserved for buyers with EXCEPTIONAL credit scores.

Catch #2: The Hidden Price Markup

Deal A: 0% APR

$35,000

Total Cost

Deal B: 3% APR

$34,011

Total Cost

The "0% APR" deal can actually cost HUNDREDS MORE because the dealer inflated the car's price.

For those who do qualify, zero percent APR doesn’t necessarily mean you’re getting a better deal. To compensate for the lost interest revenue, dealers often mark up the vehicle’s price. This markup can negate—or even outweigh—the savings from the low APR.

Imagine two scenarios. In the first, you purchase a $35,000 car with 0% APR financing over 48 months. Your monthly payment would be $729.17, totaling $35,000 over the loan term. In the second scenario, you buy a $32,000 car (the same model, but priced at market value) with 3% APR over 48 months.

Your monthly payment would be approximately $731.57, totaling $35,115.08. Despite the slightly higher monthly payment, the second deal actually saves you money because the lower purchase price outweighs the cost of interest. In this case, the "zero percent APR" deal costs you an additional $115.08 over the term of the loan.

How Loan Term Length Manipulates Your Wallet

Dealerships frequently promote extended loan terms as a solution for high monthly payments. "Lower payments, same car!" they’ll insist. But this approach ignores a critical truth: total cost matters more than monthly affordability.

How Dealers Profit From Your Loan

Tactic 1: Absorption

The dealer inflates the car's price to "absorb" the cost of a low interest rate.

A 2% APR deal on an inflated-price car can cost more than a 5% APR deal on a fairly-priced car.

Tactic 2: Dealer Reserve

The dealer charges you a higher APR than you were approved for and pockets the difference.

A 2% markup on a $30k loan can cost you over

$3,500

in extra interest!

The Myth of Lower Monthly Payments

The idea that a lower monthly payment equates to a better deal is seductive but misleading. When you extend your loan term to reduce payments, you’re effectively paying for the car—and its interest—for a longer period. This extended timeline allows interest to accumulate, often resulting in significantly higher total costs.

48 Months vs. 72 Months

Consider a $30,000 car financed at 5% APR. Over 48 months, your monthly payment would be approximately $680.27, with total interest of $3,720.25. Stretch that same loan to 72 months, and your payment drops to around $458.71. At first glance, this seems like a win—but the total interest paid increases to $4,693.03.

By choosing the longer term, you save $221.56 per month but pay an additional $972.78 in interest over the life of the loan. When you factor in the time value of money, this difference becomes even more pronounced.

Dealerships often emphasize the immediate relief of lower payments while downplaying the long-term financial impact. But as savvy buyers, we must shift our focus from monthly obligations to the total amount we’ll pay for our vehicles. After all, a car’s true cost isn’t what you pay each month—it’s what you pay in total.

Knowledge is Your Best Defense

Become a savvy buyer and take control of the deal.

Your Checklist for a Fair Deal:

- ✔ Demand an itemized breakdown of ALL fees. No surprises.

- ✔ Use an online loan calculator to verify their numbers. Trust, but verify.

- ✔ Focus on the TOTAL COST, not just the monthly payment.

- ✔ Get pre-approved for a loan from your own bank or credit union before you shop.

"A car’s true cost isn’t what you pay each month—it’s what you pay in total."

The Dark Side of “abisorption” and “Dealer Reserve”

Now, let’s venture into some of the more financial maneuvers dealerships employ—concepts that even seasoned buyers might not recognize until it’s too late. These tactics, often shrouded in complex financial jargon, can significantly impact the total cost of your vehicle without you ever realizing it. Understanding them is crucial to ensuring you’re not overpaying for your financing.

The sinister mechanics of abisorption

Have you ever wondered how dealerships can offer seemingly unbeatable interest rates while still turning a profit? The answer often lies in a practice known as “abisorption.” Here’s how it works: dealerships inflate the purchase price of the vehicle to compensate for the below-market interest rate they’re offering. Essentially, they’re absorbing the cost of the low rate into the price you pay for the car.

For example, imagine you’re looking at a car with a market value of $25,000. The dealership offers you a loan at 2% APR, which is lower than the market rate of 5%. To offset the lost interest revenue, they might increase the car’s price to $27,000. At first glance, the low APR seems like a win—but when you factor in the inflated price, you might actually be paying more in the long run compared to a standard market-rate loan at the vehicle’s true market price.

The mathematics of abisorption can be subtle but have significant implications. Let’s break it down:

- Standard market deal: $25,000 car at 5% APR over 60 months.

- Monthly payment: ~$471.78

- Total interest: ~$3,306.70

- Total cost: ~$28,306.70

- Abisorption deal: $27,000 car at 2% APR over 60 months.

- Monthly payment: ~$473.18

- Total interest: ~$1,400.70

- Total cost: ~$28,400.70

In this example, despite the lower APR, the abisorption deal ends up costing you an additional $94. Compared to the market deal, you’re paying more for the vehicle overall because of the inflated price. This practice is often hidden within the complexity of the financing process, making it easy for buyers to overlook.

The profit-driven world of dealer reserve

Another tactic that can significantly impact your financing cost is the “dealer reserve.” This occurs when banks or lenders pay dealerships a bonus for securing loans with higher-than-necessary APRs. Essentially, dealerships have a financial incentive to get you into a more expensive loan.

Here’s a simplified example to illustrate the concept:

Suppose a lender approves you for a 4% APR loan. However, the dealership, aiming to capitalize on the dealer reserve program, charges you 6% APR instead. The difference between these rates (in this case, 2%) is where the dealership’s profit comes in. Over the term of a $30,000 loan, this 2% difference can result in you paying thousands more in interest.

Let’s see the numbers:

- Approved rate (4% APR):

- Monthly payment: ~$554.76

- Total interest: ~$3,285.60

- Charged rate (6% APR):

- Monthly payment: ~$579.97

- Total interest: ~$6,797.80

The difference in total interest amounts to ~$3,512.20. That’s a substantial amount of money that goes directly into the dealership’s pocket, thanks to the dealer reserve arrangement.

Both abisorption and dealer reserve practices highlight how the financing process can be manipulated to increase dealership profits at the buyer’s expense. By understanding these tactics, you can become more vigilant when negotiating your car purchase and financing terms.

Conclusion

Car financing is fraught with hidden costs, manipulated rates, and psychological tactics designed to maximize dealership profits. From abisorption and dealer reserve to the misdirection of monthly payment focus, the system is stacked in favor of the seller. But knowledge is power. By understanding the mathematical truths behind financing—principal vs. interest, APR calculations, term length impacts, and hidden fees—you can navigate the buying process with clarity.

Always ask for transparency: itemized fee breakdowns, clear APR explanations, and total cost disclosures. Use online calculators to verify the numbers yourself and compare different financing options. And remember, if a deal seems too good to be true, it probably is.

Armed with this awareness, you can transform those “great financing deals” into genuinely great deals that serve your financial interests, not just the dealership’s bottom line. The next time you walk into a dealership, you’ll be equipped to see beyond the sales pitch and make choices that truly benefit you.